- Indices

- Stocks

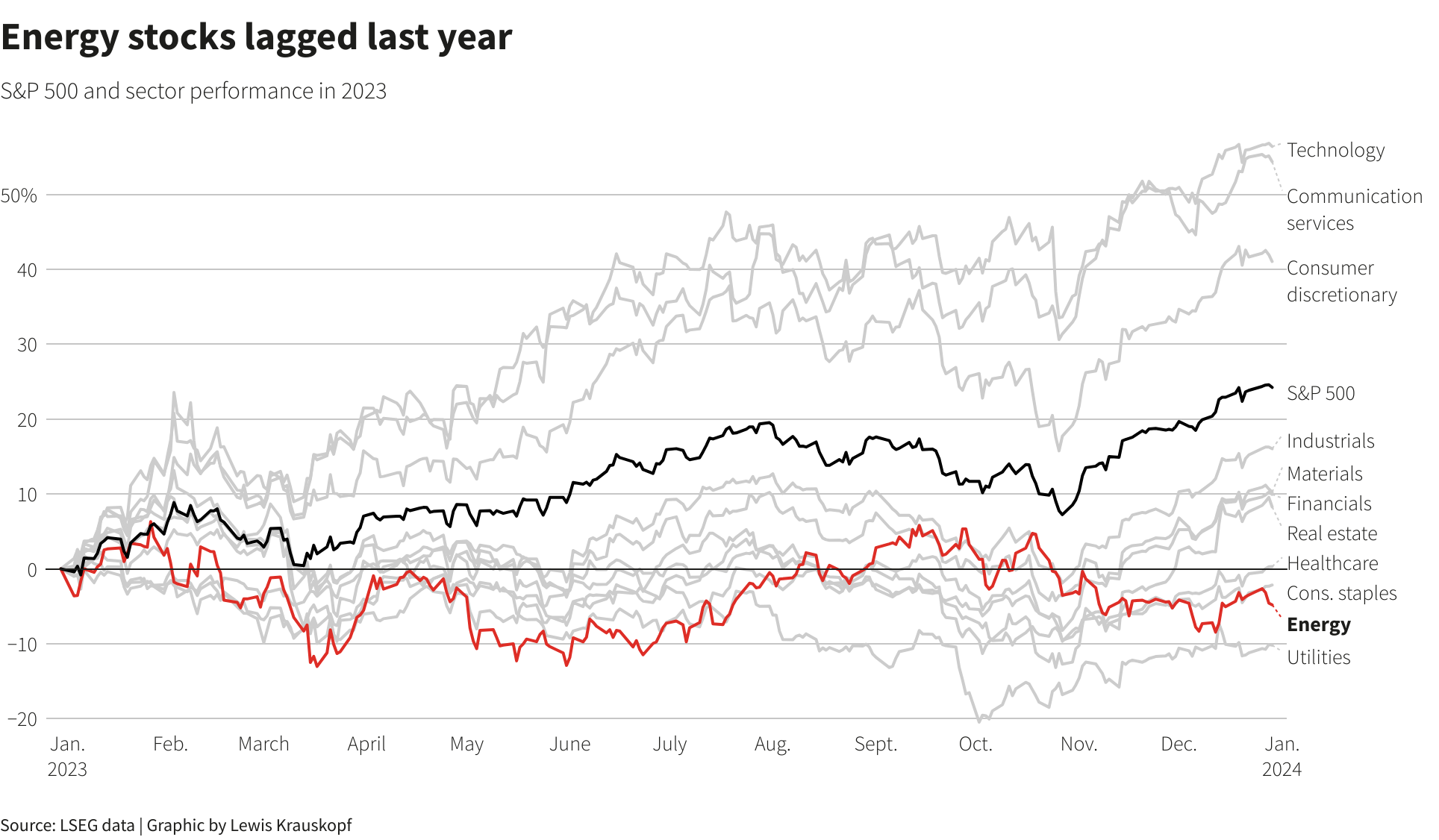

Energy companies are struggling

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

Key points:

- Despite the overall rally in the US stock market, energy stocks are lagging.

- Declining oil prices are one of the main reasons for the problems in the sector. US oil prices have fallen more than 20% since late September, to around $73 a barrel.

- Energy company earnings are expected to grow 1.6% in 2024.

Despite the overall surge in the U.S. stock market, energy stocks have remained sluggish. However, optimistic investors anticipate that upcoming earnings reports and escalating geopolitical tensions could revitalize the beleaguered sector.

The energy sector (.SPNY) has shed nearly 3% of its value since late October, while the broader S&P 500 has soared 16%. The benchmark index has gained 24% in 2023, while energy has plummeted 4.8%, marking the second-largest decline among S&P 500 sectors last year.

Though challenges persist within the sector, other economically sensitive groups like banks and small-cap stocks have benefited from mounting investor confidence in a “soft landing” for the economy, characterized by sustained growth while inflation recedes.

Causes of the crisis

A primary factor contributing to the sector’s subpar performance has been the steep decline in oil prices. U.S. crude has plunged over 20% since late September, settling around $73 per barrel, under pressure from ample supplies – particularly in the U.S. – and concerns about tepid demand in China and Europe, according to investors.

Strategists at Wells Fargo Investment Institute have upgraded their rating on the energy sector from “neutral” to “favorable” this week, stating their belief that “oil prices will reach their nadir alongside the global economy and then end the year higher.”

The power of geopolitical factors

Mounting geopolitical tensions in the Middle East and any potential decision by OPEC regarding crude production could significantly influence near-term oil prices.

On Friday, US oil prices surged by 4.5% and then gained another 0.9% after several oil tankers retreated from the Red Sea following overnight airstrikes by US and British forces against Houthi targets in Yemen. Energy sector stocks ended the day with a 1.3% gain.

“Although the resolution of the Red Sea problems will be negative for oil, it appears that the situation is escalating and the risk should lead to higher oil prices,”

– wrote Mike O’Rourke, chief market strategist at JonesTrading.

Expectations from the energy market

Despite a projected 26% decline in 2023 earnings, LSEG data indicates a glimmer of hope for the energy sector in 2024, with a projected 1.6% revenue growth.

Walter Todd, chief investment officer at Greenwood Capital, cited improving earnings trends, attractive valuations, and the sector’s potential as a hedge against escalating geopolitical tensions as factors supporting energy stocks.

While energy earnings are expected to rebound, the sector’s overall performance is projected to align with the S&P 500, with a predicted 11.1% growth in 2024.

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars