- Commodities

US soybean exports exceed expectations

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

Key points:

- Soybean export sales exceeded expectations but remain weak.

- Large inventories in Brazil and low demand from China are hampering soybean exports.

- Export orders for US corn were better than for soybeans.

While U.S. soybean export sales topped analysts’ forecasts last week, that doesn’t indicate robust demand from international buyers. The USDA projects the nation’s soybean exports in 2023-24 to be the second highest in a decade. However, given some recent trends, this forecast may be too optimistic.

Soybean sales figures

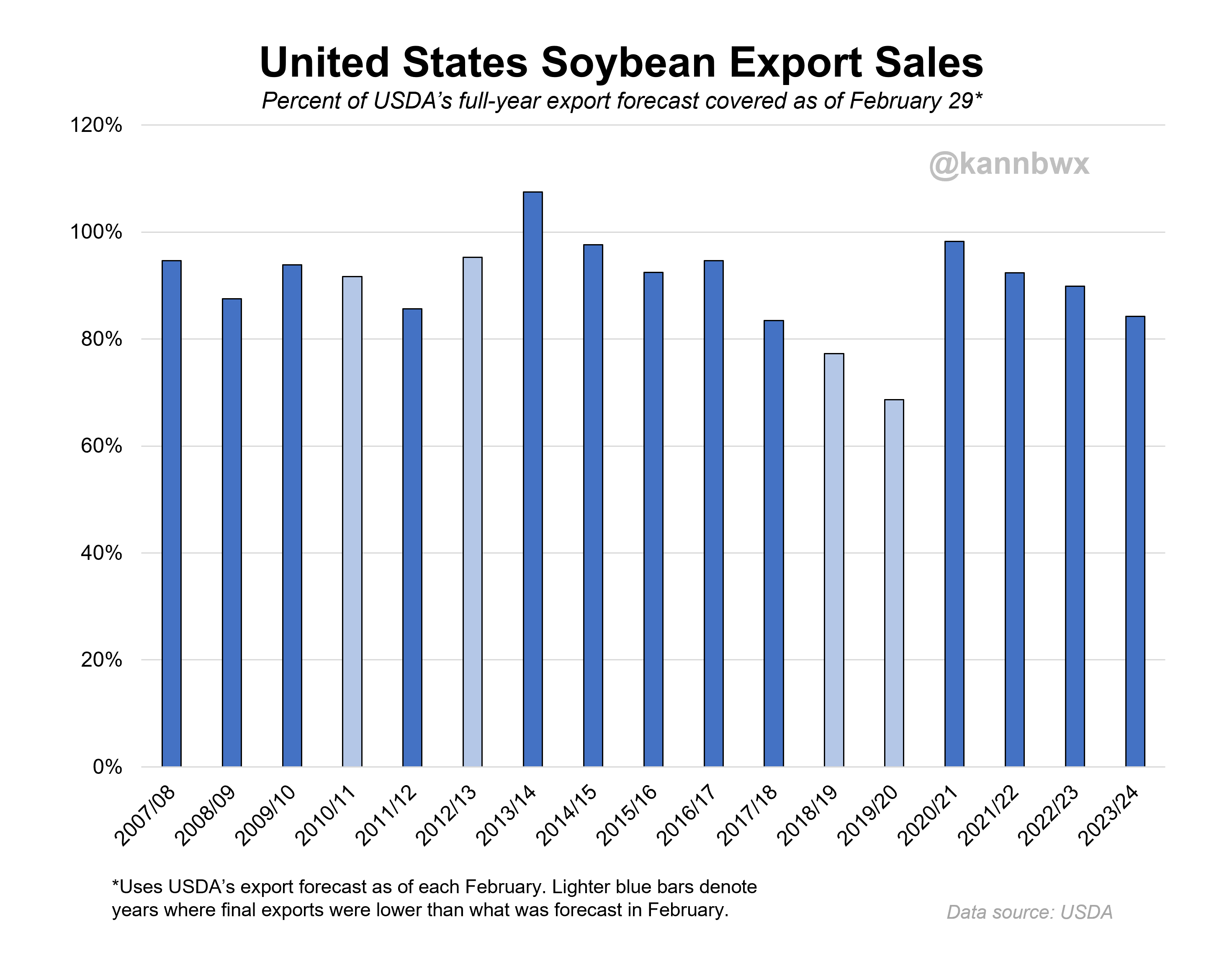

As of February 29, 2024, U.S. soybean export sales for the 2023-2024 marketing year (beginning September 1) reached 39.4 million tons. This represents 84% of the US Department of Agriculture’s (USDA) annual target of 46.8 million tonnes.

For comparison, last year at the same date 90% of the annual volume was sold, and the average for the last three years is 94%. This makes the current sales level the second highest in more than a decade (after 83% in 2017-2018).

It’s important to note that, with the exception of the 2018-2019 and 2019-2020 trade wars, final soybean exports generally have not fallen below the USDA’s February forecast. In 2017-2018, despite the outbreak of a trade war with China and crop problems in Argentina, export sales still increased.

Why have soybean sales been so low?

Despite the weak outlook, the lowest level of U.S. soybean export sales over the past 16 years remains within historical norms. The current rate is 7% of the USDA’s annual target, below the five-year average of 13%. The previous lowest figure was recorded in 2016-2017 (9%).

The agricultural industry was not prepared for such low sales volumes. Over the past 10 weeks, the range of weekly export figures has fluctuated from 3.7 to 9.2 million tons. Sales were initially forecast to be 3.5 million tonnes, but in 7 of the last 10 weeks, actual exports fell below even the lowest analyst forecast.

Data released Feb. 29 showed soybean sales for the week hit a seven-week high of 614,000 tons. This value is slightly above average and barely exceeds the trade maximum of 600,000 tons.

US soybean exports are hampered by two main factors:

- Large crop reserves in Brazil, which put pressure on world prices.

- Declining demand from China, which is the largest buyer of American soybeans. Low sales margins make the Chinese market less attractive to U.S. exporters.

Corn sales turned out better

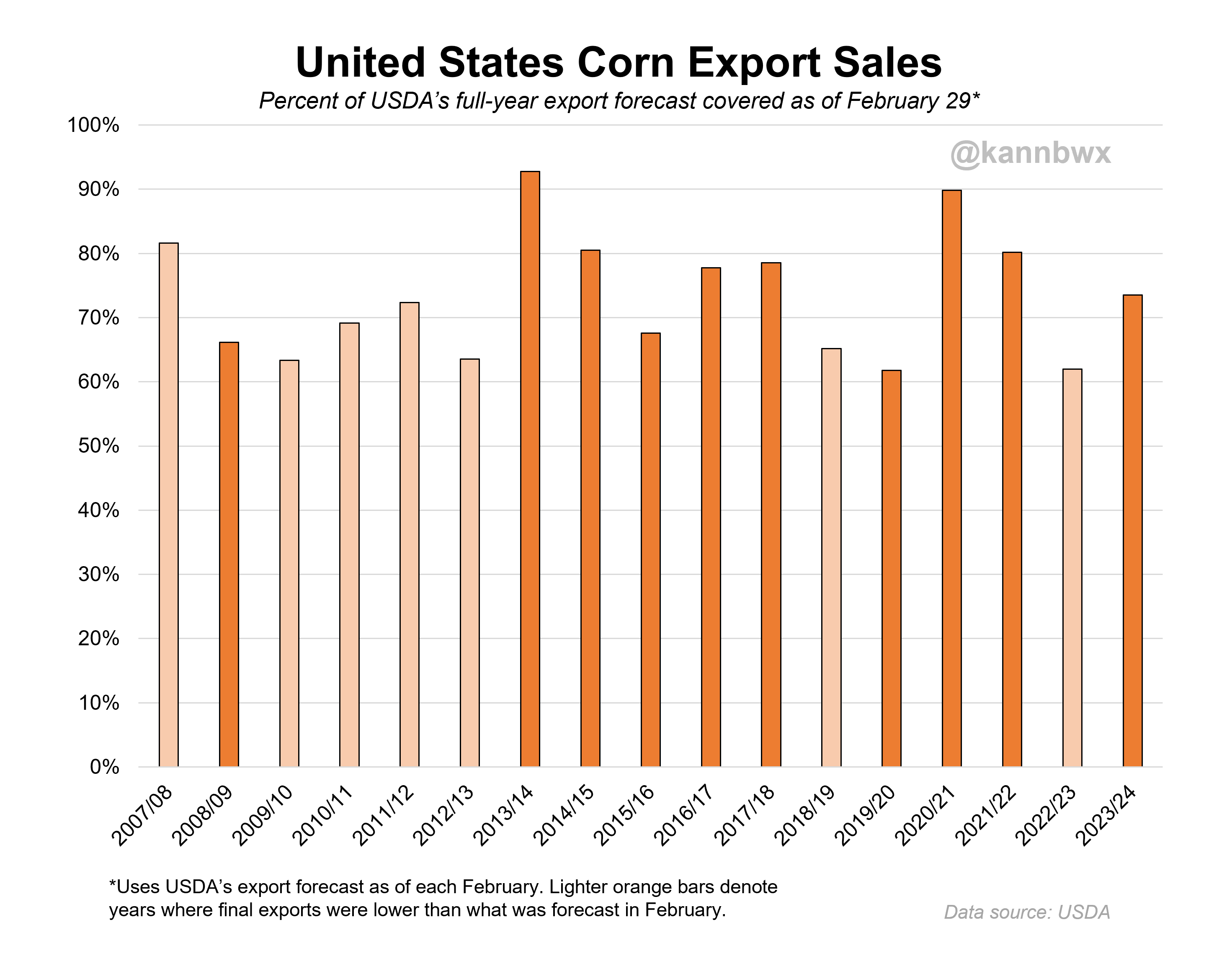

U.S. corn export sales were more optimistic than soybean sales as of February 29, 2024. So far, 39.2 million tons of corn have been contracted, representing 74% of the USDA’s annual forecast of 53.3 million tons.

By comparison, the five-year average for corn exports on this date is 72%, ranging from 62% in 2019-2020 and 2022-2023 to 90% in 2020-2021.

As with soybeans, final U.S. corn exports in recent years have generally matched or exceeded the USDA’s February forecast. There have been only two exceptions in the last decade – 2018-2019 and 2022-2023, when 65% and 62% of the annual volume were reserved by February, respectively.

It is worth noting that over the past 10 weeks, corn export sales reached 9.8 million tons, which is a three-year high for this period. This represents 18% of the annual target, slightly below the average in recent years (about 19%).

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars