- Indices

- Stocks

US market indices decline in 2024

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

Key points:

- The S&P 500 and Nasdaq Composite indices ended the first trading session of 2024 lower.

- U.S. Treasury yields rose above 4.000% to a two-week high before easing slightly to 3.937%.

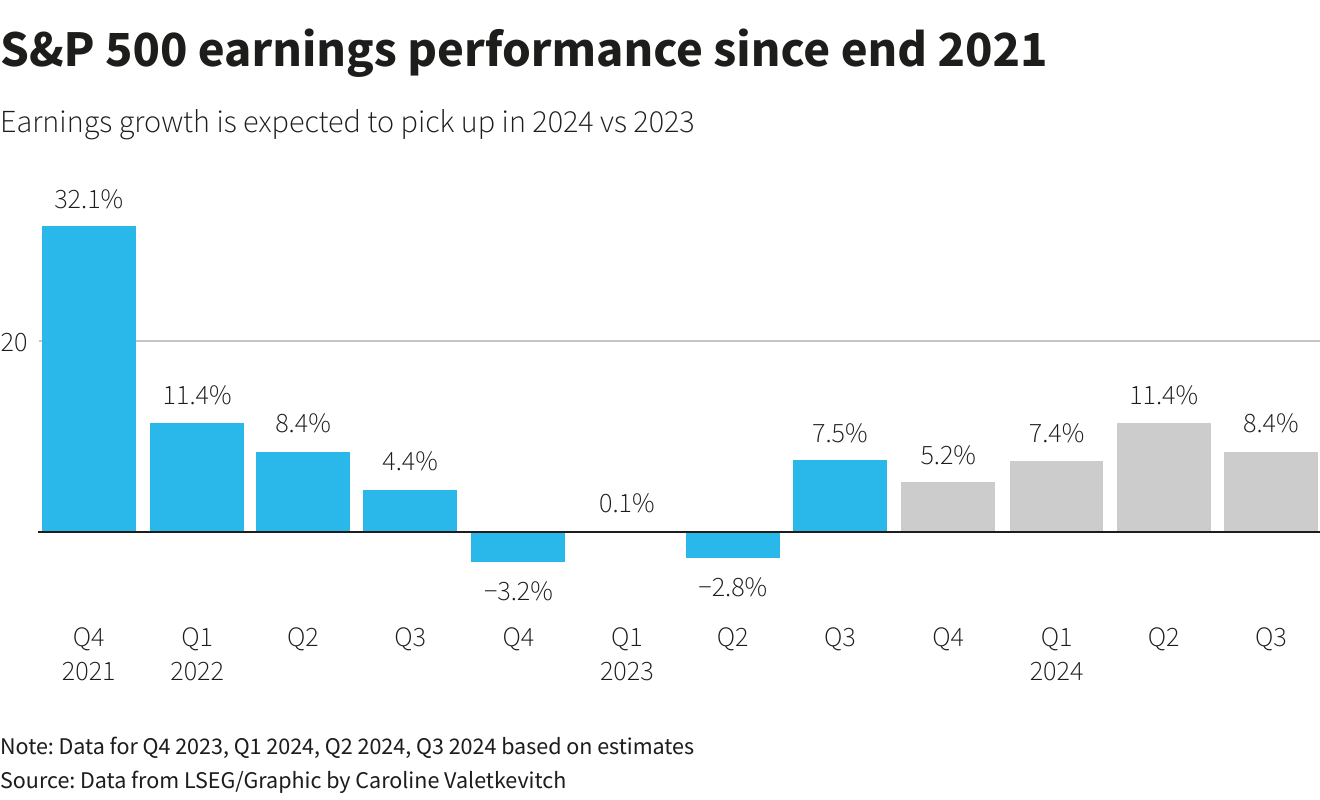

- Analysts forecast US corporate earnings should improve at a stronger pace in 2024.

The S&P 500 and Nasdaq Composite indices kicked off the year with a decline, influenced by a slump in Apple’s stock price following a broker’s downgrade and a broader retreat among major tech companies driven by soaring U.S. Treasury yields.

The S&P 500 (.SPX) shed 27 points, or 0.57%, to settle at 4,742.83, while the Nasdaq Composite (.IXIC) plummeted 245.41 points, or 1.63%, to 14,765.94. The Dow Jones Industrial Average (.DJI) narrowly escaped the downturn, edging up 25.5 points, or 0.07%, to 37,715.04.

The lackluster performance comes after a stellar year for Wall Street, where the three major indexes registered double-digit gains amidst optimism about artificial intelligence and moderating inflation. The S&P 500 closed last week within a hair’s breadth of its all-time closing high set in early 2022.

However, US Treasury bond yields surged, peaking above 4.000%, their highest level in two weeks, before easing slightly to 3.937%. This upward trend reflects a moderate expectation among investors that US interest rates will decline this year.

In turn, this expectation weighed on stock prices, particularly those of technology companies that would benefit from lower interest rates.

“But does this mean that we are already out of the crisis? “I suspect that even if the Fed gradually cuts rates, monetary policy will still remain tight and will likely still be a drag on overall economic activity.”

says Jason Pride, head of investment strategy and research at Glenmede.

While most believe the Federal Reserve kept interest rates unchanged at its January meeting, market participants are betting on a strong likelihood of a 25 basis point rate reduction in March, with odds of around 70%, as indicated by the FedWatch tool.

Stock dynamics in early January

Apple’s stock price plunged 3.6% after Barclays downgraded the tech titan to “underperform,” citing weakening demand for iPhones. Other tech giants also sank, with Nvidia, Meta Platforms, and Microsoft shedding between 1.4% and 2.7% of their value.

The S&P 500 sectors exhibited a mixed performance. Healthcare emerged as the strongest performer, surging 1.8% to reach its highest closing level since mid-December 2022. Moderna’s shares soared 13.1%, leading the sector’s gains after the vaccine maker received an upgrade from brokerage Oppenheimer and reiterated its goal of achieving sales growth in 2025.

The energy sector defied the general decline, rising 1.2%, despite falling oil prices, as concerns about the economic outlook persisted.

Information technology led the losses, plummeting 2.6%, marking the index’s largest single-day drop since August 2.

Tesla stock remained unchanged despite the company announcing record electric vehicle deliveries in the fourth quarter, exceeding market expectations and achieving its 2023 target of 1.8 million vehicles.

US earnings growth will accelerate in 2024 despite economic risks

Analysts anticipate that U.S. corporate profits will witness a more robust growth trajectory in 2024, driven by anticipated declines in inflation and interest rates. However, the specter of an economic slowdown continues to loom. LSEG estimates that S&P 500 earnings will expand by 11.1% overall.

The Dow Jones Industrial Average achieved its first record-breaking closing level since January 2022 in December, and the S&P 500 is inching closer to its own record closing level. The S&P 500 has gained a substantial 24.2% for the year thus far.

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars