- Indices

- Stocks

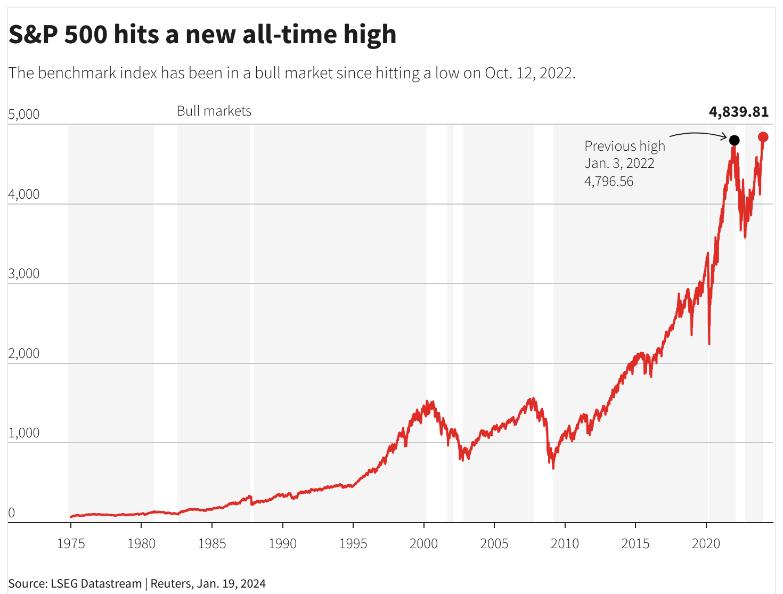

S&P 500 closes on the all-time high level

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

Key points:

- The S&P 500 stock index reached a record closing high of 4,839.81 on January 20, 2024.

- Expectations of lower interest rates and robust growth in 2024 helped propel stocks higher.

- Rising large technology stocks and optimism about artificial intelligence also contributed to the positive market performance.

Rising expectations for lower interest rates and sustained economic growth in 2024 propelled the S&P 500 stock index to a new record high on Friday, capping off a volatile period marked by escalating inflation, financial market turbulence, and mounting concerns about a potential recession.

The benchmark index closed at 4,839.81, surpassing its previous all-time closing high of 4,796.56 set on January 3, 2022. The index also reached an intraday record high of 4,842.07 during the trading session.

The stock market’s ascent began to falter in early 2022 amidst fears that rising consumer prices would compel the Federal Reserve to raise interest rates. The central bank’s aggressive monetary tightening cycle sent Treasury yields to 16-year highs and triggered a market sell-off.

While the S&P 500, along with other major indices, experienced a temporary decline in early 2024, this setback proved to be short-lived.

What promotes optimism in the stock market

The robust performance of major technology companies and the growing excitement about artificial intelligence continued to drive stock market gains on Friday, echoing the momentum seen throughout 2023.

The so-called “Magnificent Seven” technology stocks – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla – exhibited exceptional growth last year, with their share prices surging by anywhere from 50% to a remarkable 240%. Together, these seven companies represent approximately 28% of the S&P 500’s overall market capitalization.

The broader technology sector (.SPLRCT) has also experienced significant growth, climbing by over 70% from its low point in October 2022. The communications services sector (.SPLRCL), which houses companies like Meta Platforms and Netflix, has notched up gains of nearly 60%.

Another key factor contributing to the upward trajectory of stock prices is the fervent anticipation surrounding artificial intelligence technology. Companies like Nvidia, now the world’s most valuable chipmaker after its stock value tripled last year, have benefited immensely from this surge in interest. This positive trend continued into 2024, propelling Nvidia’s stock to a record high on Friday.

The state of the American economy

The interplay between stock prices and Treasury yields has played a pivotal role in shaping market movements over the past two years. Yields soared when the Federal Reserve embarked on an interest rate hike cycle to combat inflation, culminating in a 16-year high in October 2023. This upward trajectory was further exacerbated by financial market turbulence that fueled a sell-off in U.S. government bonds.

Anticipation of a rate cut in 2024 has exerted downward pressure on Treasury yields in recent months, leading to a decline in the benchmark 10-year Treasury yield from a peak of 5% to around 4.2%. However, yields have begun to tick up again in recent weeks as investors reassess their bets on the Fed’s monetary policy stance.

Another crucial factor underpinning stock market gains is the belief that the Fed’s tightening policies can effectively tame inflation without causing a severe economic slowdown – a scenario known as a soft landing.

The U.S. economy has demonstrated remarkable resilience despite headwinds, as evidenced by recent reports indicating positive trends in areas like retail sales and consumer sentiment.

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars