- Indices

- Stocks

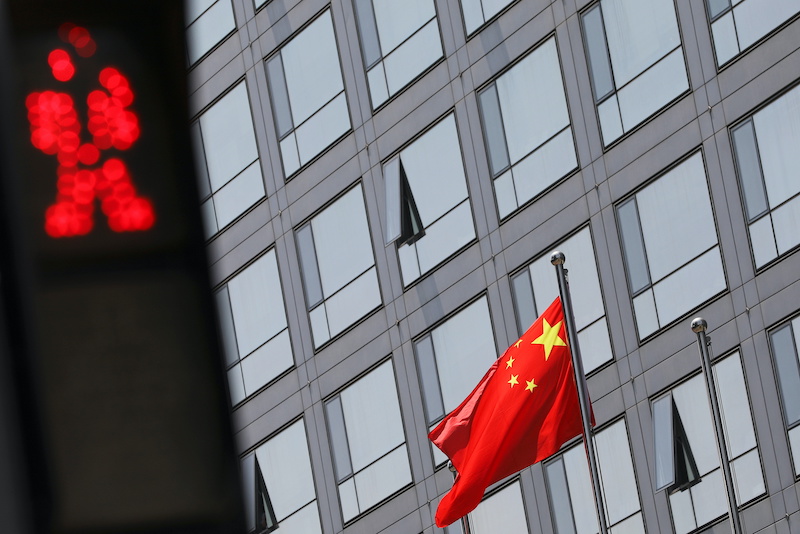

Markets decline amid Chinese policy

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

Key points:

- Global stocks fell below recent highs due to the lack of large-scale economic stimulus from China.

- China has set a GDP growth target of 5% for 2024.

- The US dollar index rose 0.1% to 103.92 points.

Global stocks fell below their recent highs on Tuesday 5 March. China failed to unveil any major stimulus plans at the start of the week-long annual session of parliament, leaving investors disappointed.

In addition, investor sentiment was negatively impacted by the March 4 retreat from record highs on Wall Street. The US Federal Reserve has not yet demonstrated its readiness to lower interest rates as soon as possible, which also did not add optimism to the markets.

The decline also affected US stock futures, which also showed negative dynamics.

China’s solutions

Beijing maintained its GDP growth target of “around 5%” for 2024, repeating last year’s goal. It also plans to maintain the budget deficit at 3% of GDP, lower than the revised 3.8% for 2023. In addition, the release of special ultra-long-term treasury bonds worth 1 trillion yuan ($139 billion), not included in the budget, was announced.

The stock market was in a correction, with the blue-chip CSI 300 index up 0.7% after a morning decline. The positive dynamics were provoked by assumptions about purchases of exchange-traded funds by government agencies. In Europe, where many large companies are heavily dependent on the Chinese economy, the STOXX 600 index showed a decline of 0.3%.

Currency dynamics

The US dollar index was 0.1% higher at 103.92 points.

The euro was down 0.1% at $1.0845 ahead of Thursday’s ECB meeting, where traders expect there will be no rate change. Futures contracts indicate an 88% chance of a rate cut cycle starting in June, which coincides with the projected timing of the first cut in the US.

Sterling was down 0.1% at $1.2673 ahead of the UK budget scheduled for Wednesday. Treasury Secretary Jeremy Hunt is keen to curb speculation about pre-election tax cuts.

The dollar-yen exchange rate remained unchanged at 150.42 after rising 0.27% on Monday. This currency pair is traditionally sensitive to fluctuations in long-term US bond yields. The yield on the 10-year US Treasury note fell 2 basis points to 4.195%, its lowest level in two weeks.

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars