- Stocks

Microsoft spending in focus for traders

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

Key points:

- Investors await Microsoft earnings call, focusing on AI impact.

- Microsoft is expected to report solid 31% quarterly growth in Azure.

- The company is investing heavily in AI infrastructure, and investors are eager to see how well those investments are paying off.

Investors in Microsoft are eagerly awaiting the company’s earnings report on Tuesday, with their main interest focused on the growth dynamics of its cloud division, Azure. The main question on the market is how much growth there is to justify the company’s massive investments in AI infrastructure.

Microsoft, which is widely seen as a leader in the race to monetize AI technology thanks to its close ties to OpenAI, the creator of ChatGPT, is expected to show solid quarterly Azure growth of about 31% for the April-June period, according to analytics firm Visible Alpha.

Microsoft’s upcoming report

The preliminary figures are in line with the company’s guidance, but investors are expecting a more significant contribution from the AI unit in the fourth fiscal quarter. As a reminder, AI accounted for 7% of Azure’s growth in the first three quarters of the current fiscal year.

According to a survey of 16 analysts, Microsoft’s capital expenditures likely increased by about 53% year-on-year to $13.64 billion in the reporting period. This is significantly higher than the $10.95 billion spent in the previous quarter.

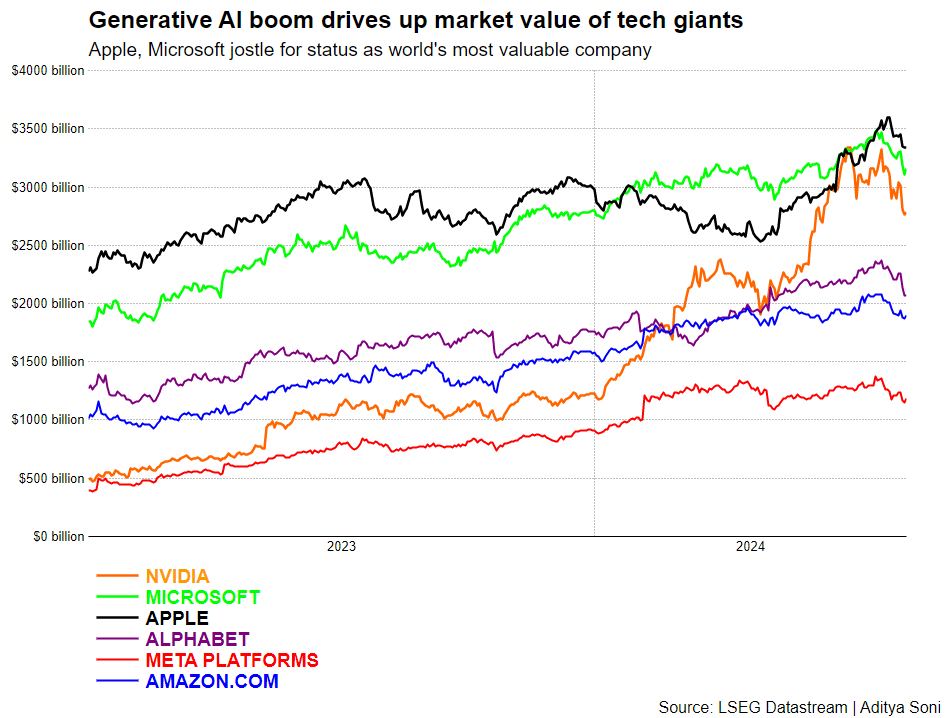

There has been some concern in the US stock market this month about the excessive capital expenditures of tech giants on data centers. Investors are worried that these expenditures will not yield tangible short-term returns. This is due to a growing understanding that Wall Street may have overstated its expectations for the pace of profit growth.

Google Case

Shares of Google parent Alphabet fell more than 5% last week after the company reported quarterly earnings results that showed capital spending exceeding analysts’ estimates by nearly $1 billion, while AI revenue growth was weaker than expected. The results sparked a sell-off in major tech stocks.

Alphabet said it will maintain high capital spending of $12 billion or more through 2024.

“Investors will be watching closely to see whether Microsoft can continue to accelerate its revenue growth, particularly in AI. If it can’t, while maintaining high capital spending, investors could be disappointed,” said Gil Luria, senior software analyst at D.A. Davidson.

Microsoft is making the case for significant data center investments to overcome the computing power constraints that are holding back the full potential of AI demand.

Microsoft’s stance is echoed by other tech giants, including Alphabet. Google CEO Sundar Pichai stressed last week that “the risk of underinvesting in AI infrastructure far outweighs the risk of overinvesting.”

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars